How Can You Earn Passive Income Through KuCoin Lending?

While trading and staking are popular options, they often require active involvement or lock up your assets for long periods.

What if there was a way to earn a steady, predictable income from your crypto holdings with minimal effort? Enter KuCoin Lending, a powerful and accessible tool that allows you to generate passive income from your digital assets.

This guide will walk you through everything you need to know about KuCoin Lending, from what it is to how you can start earning today.

What is KuCoin Lending?

KuCoin Lending is a feature on the KuCoin exchange that connects crypto holders (lenders) with margin traders (borrowers). In simple terms, you lend your crypto assets to traders who need extra funds to amplify their positions. In return for providing liquidity, you earn interest on the amount you lend.

This is a peer-to-peer lending system facilitated and secured by the KuCoin platform. The process is fully automated, transparent, and designed to be straightforward, even for those new to the world of decentralized finance (DeFi). The interest rates are determined by the market, ensuring you receive a fair return for your capital.

Why Choose KuCoin Lending?

Choosing a passive income strategy is a big decision, and KuCoin Lending stands out for several compelling reasons:

-

Effortless Passive Income: Once you've set up a loan order, the process is fully automated. You don't need to monitor market trends or make trading decisions. Your assets work for you 24/7.

-

Flexibility and Control: Unlike some staking platforms, KuCoin Lending offers flexible loan terms—7, 14, or 28 days. You also have the freedom to set your preferred daily interest rate. If your loan doesn't get filled at your desired rate, you can adjust it to be more competitive.

-

High Liquidity: KuCoin is one of the largest cryptocurrency exchanges in the world, with a massive user base. This ensures there is a constant demand from margin traders, meaning your assets are more likely to be borrowed and start earning interest quickly.

-

Low Risk: KuCoin operates a robust risk management system. Borrowers are required to provide collateral that is a minimum of 1.25 times the loan amount. If a borrower's collateral falls below a certain threshold, a margin call is triggered, and their position is automatically liquidated to protect the lender’s funds.

Read more: https://cashbackkucoin.com/kucoin-news/

How to Start KuCoin Lending: A Step-by-Step Guide

Getting started is a simple process that can be completed in just a few minutes.

-

Fund Your Main Account: Ensure you have the cryptocurrency you want to lend in your KuCoin Main Account. If your assets are in your Trading Account, you'll need to transfer them back to the Main Account first.

-

Navigate to the Lending Page: On the KuCoin platform, go to the “Earn” section and select “Crypto Lending.”

-

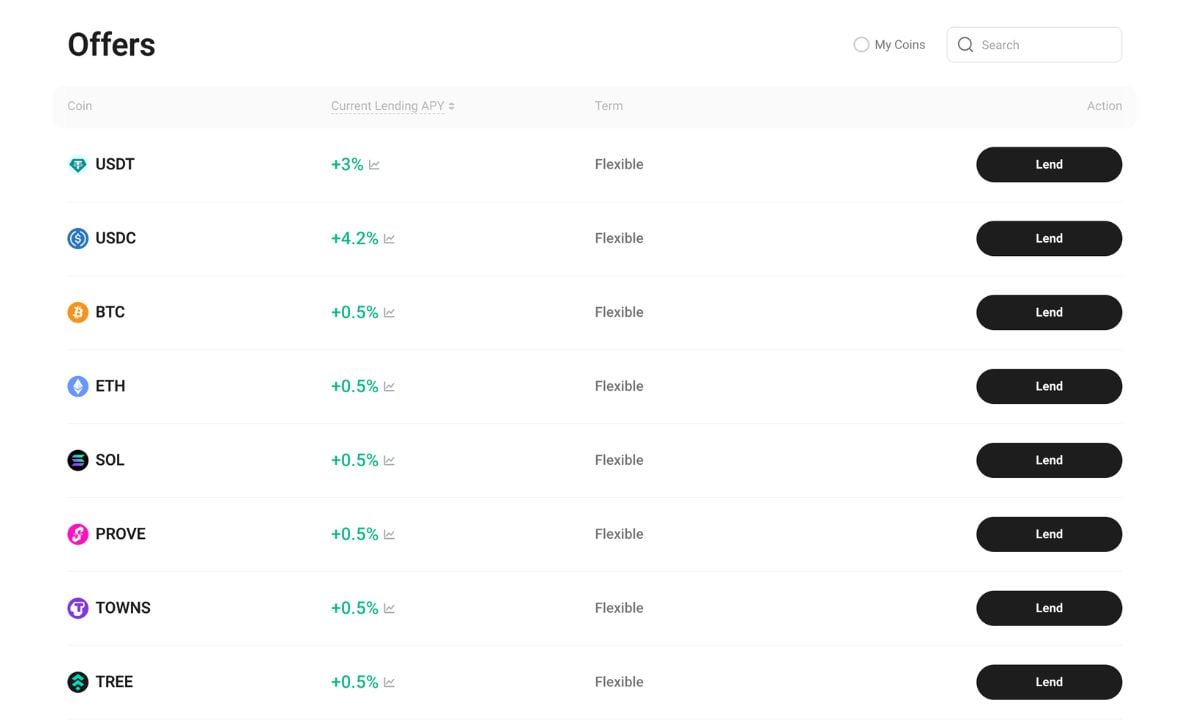

Choose Your Asset: Select the cryptocurrency you want to lend from the list provided. Popular options include USDT, BTC, ETH, and numerous other altcoins.

-

Set Your Parameters:

-

Amount: Enter the amount of crypto you wish to lend.

-

Daily Interest Rate: You can manually set your desired interest rate. The system will also show you the market's daily lending rate for your reference.

-

Term: Choose your preferred loan term (7, 14, or 28 days).

-

-

Enable Auto-Lend (Highly Recommended): This feature is a game-changer. By enabling "Auto-Lend," KuCoin will automatically relend your principal and interest once a loan term expires. This ensures your capital is continuously working, maximizing your earnings and harnessing the power of compound interest.

-

Confirm the Order: Once you have reviewed your settings, click "Lend" to publish your loan order. Once a borrower accepts your terms, the loan will begin.

Maximizing Your Earnings and Mitigating Risks

To get the most out of your KuCoin Lending experience, consider these expert tips:

-

Diversify Your Portfolio: Don't put all your crypto into a single lending asset. Lending different coins allows you to spread risk and take advantage of varying interest rates.

-

Use the Auto-Lend Feature: As mentioned, this is the most effective way to earn. By having your funds automatically reinvested, you ensure zero downtime and benefit from compounding returns.

-

Monitor Market Rates: Periodically check the market interest rates for different assets. Interest rates can fluctuate based on supply and demand. Adjusting your rate can help you get your loans filled faster.

-

Stay Informed About Promotions: Keep an eye out for special KuCoin promotions. Sometimes, the exchange runs campaigns that offer additional rewards, such as a Cashback KuCoin event on fees, further boosting your overall profitability.

Is KuCoin Lending Safe?

Yes, KuCoin Lending is designed with security and risk mitigation as top priorities. While no financial activity is completely without risk, KuCoin has built-in safeguards to protect lenders:

-

Collateral Requirements: Borrowers must overcollateralize their loans, meaning they must deposit more assets than they borrow.

-

Forced Liquidation: If a borrower's collateral value drops below a certain level due to market volatility, KuCoin's system automatically liquidates their position to repay the lender's principal and interest.

-

KuCoin Insurance Fund: In the unlikely event of an unrecoverable default, KuCoin maintains an insurance fund to cover the deficit, providing an extra layer of protection for lenders.

In conclusion, KuCoin Lending offers a compelling and secure way to generate a passive income stream from your crypto holdings. It provides a flexible, low-effort alternative to traditional trading or long-term staking, allowing you to truly make your assets work for you.

Author: Minh Crypto

Remplacez les images

Remplacez les images

Remplacez les textes

Remplacez les textes

Personnalisez !

Personnalisez !